How the EU is Targeting Cryptocurrency to Combat the Darknet.

A new cryptocurrency report funded by the EU commission has just been released. Mainly, the report was financed in order to find a way to combat the darknet. The report concluded that banning cryptocurrencies outright is not a good option. Rather it focuses on surveilling blockchains and tougher ID checks related to cryptocurrencies. This report comes at a time that law makers are also pushing for much tougher regulations on cryptocurrencies. Here is what this possibly means for the future of cryptocurrencies in the European Union.

A Report by Chainalysis

Being authored by Chainalysis cryptocurrency experts Eric Jardine and Kim Graue, the latest report was directly funded by the EU. Chainalysis is a blockchain analysis company that provides tools and services. The company’s customer list mainly consists of governments and law enforcement agencies. Their tools are used to investigate and prevent cryptocurrency-related crimes such as money laundering, fraud, and terrorism financing. The company’s software helps its clients identify and track cryptocurrency transactions.

The Findings: Future Regulations.

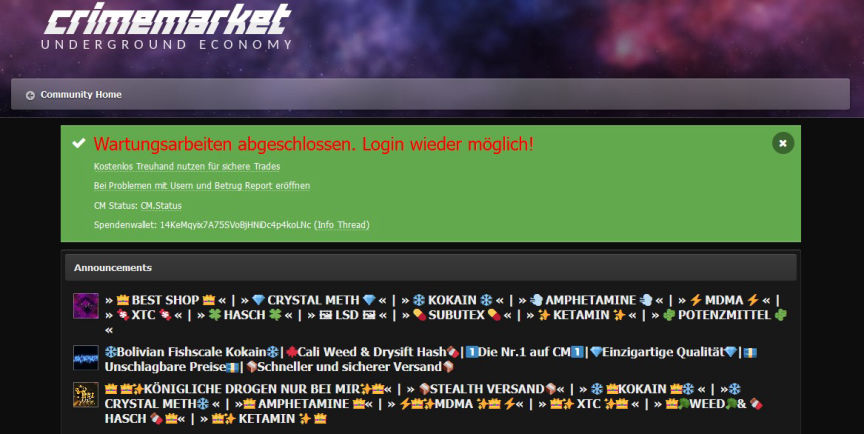

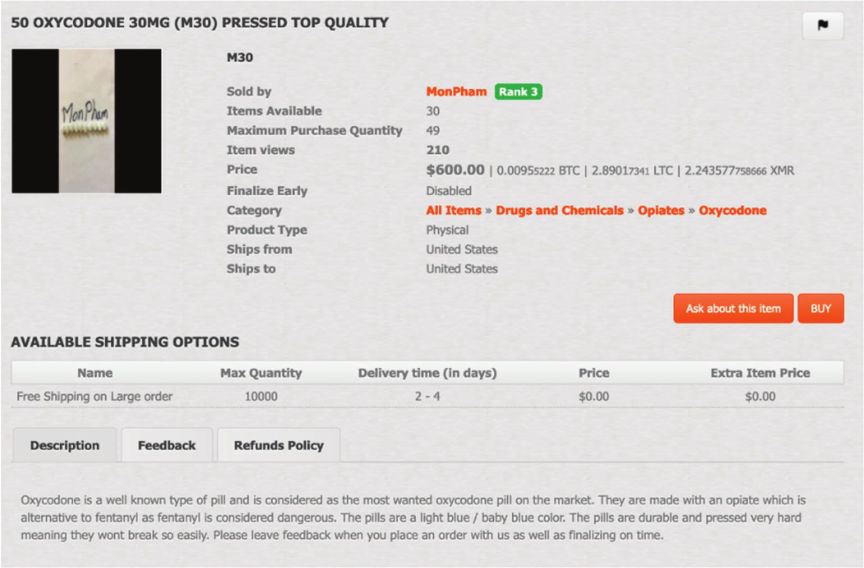

The main objective of this report was to find ways to curb dark-net crimes. Despite lawmakers suggesting to outright ban cryptocurrencies, the latest report dismissed such ideas. The report also goes over law enforcement efforts in combating dark-net markets, sighting the latest seizure of the infamous Hydra marketplace. The conclusion on such seizures was that they are short lived, with more new markets quickly taking the spot of ones that shut down. Based on this, the report came to the conclusion that the best way to combat dark-net crime is to focus on the currencies instead of the markets.

With this in mind, the report goes over many ways that governments can use to strictly control cryptocurrencies. The suggested regulations will mainly target people and organizations that sell crypto, instead of the end user. This will be done by enforcing strict rules, forcing such sellers to check and collect more identification from users. It is unclear what form of ID checks will be performed, especially as regulations are already fairly strict in the region.

The report also goes over existing surveillance and analysis tools that can be used to track cryptocurrency transactions. It sights the need for increased training in governments on how to use such tools. Considering the recent rise in privacy coins it is unclear how effective such tools will be. Another important note is that the article is written by a company that provides such tools, meaning there is potential conflict of interest.

Existing Cryptocurrency Regulations

The European Union (EU) has been active in developing regulations for cryptocurrencies and related activities in recent years. The EU’s Fifth Anti-Money Laundering Directive (5AMLD), which came into effect in January 2020, requires virtual asset service providers (VASPs) to comply with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. This includes conducting customer due diligence and reporting suspicious transactions to authorities.

Some EU member states, such as Germany and France, have taken a proactive approach to regulating cryptocurrencies within their own borders. For example, Germany has classified cryptocurrencies as financial instruments and requires exchanges and custodians to obtain a license from the Federal Financial Supervisory Authority (BaFin) to operate. France has established a regulatory framework for initial coin offerings (ICOs) and requires VASPs to obtain a license from the Autorité des marchés financiers (AMF).

Future Regulations

Despite the strict rules already in place, they are not consistent across the entire regions. Some EU countries turn a bling eye, while some how beyond the existing regulations. This is likely to change with much more detailed, and widely implemented regulations.

Next week EU regulators will be voting on such regulations. The bill titled Markets in Crypto Assets Regulation (MiCA) will be a major landmark if passed. The regulations will force people or organizations selling cryptocurrencies to obtain a license. Stricter oversight will also be implemented. Some reports even claim that if passed, identity checks will be required even to transfer funds.

The Reality of Such Regulations

Based on the nature of blockchain technology, implementing such regulations will be really complicated. Even so, it is not guaranteed to stop or reduce any crime. It will be much more difficult for users to send fund to someone without the government knowing, but this will apply to coins purchased after the regulations are implemented. With so much cryptocurrency in the wild outside of government control, such checks will be impossible to perform.